Child Tax Credit 2024 Eligibility Requirements California – The framework suggests increasing the maximum refundable portion of the CTC from the current $1,600 per child Tax Credit will build more than 200,000 new affordable housing units.” The changes . The 2024 tax season is starting soon, and you may be looking for all the tax credits you’re eligible for. If you have kids, you probably already know whether you’re eligible for the federal child tax .

Child Tax Credit 2024 Eligibility Requirements California

Source : www.healthforcalifornia.com

The (Pretty Short) List of EVs That Qualify for a $7,500 Tax

Source : insideclimatenews.org

Child Tax Credit 2023 2024: Requirements, How to Claim

Source : www.nerdwallet.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

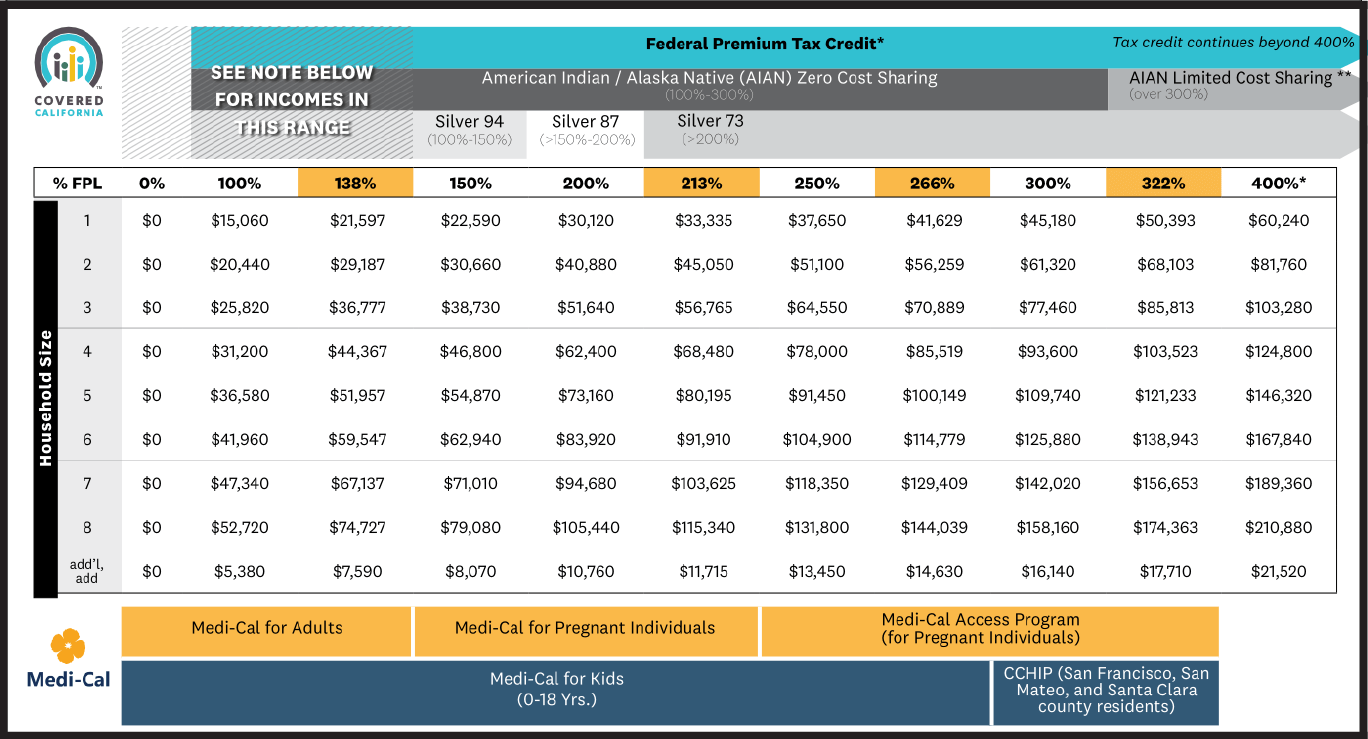

Covered California Tax Credits 3 ways to big saving!

Source : covered-fresno.com

California Stimulus Check 2024, Eligibility, Filing Method, Cash

Source : www.bscnursing2022.com

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

The $7,500 EV tax credit will see big changes in 2024. What to

Source : www.npr.org

dddd278b 1cdb 4f7a 9672

Source : media.cbs8.com

Child Tax Credit 2024 Eligibility Requirements California Covered California Income Limits | Health for California: People filing in 2024 are filing for the year 2023. The Child Tax Credit offers support also exist too. To be eligible, people must meet a series of criteria in categories such as the child’s . To be eligible, people must meet a series of criteria in categories such as the child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April 15, 2024 .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)